Term Life Insurance: A Comprehensive Guide to Secure Your Future

Life insurance is a crucial component of financial planning. Among the various types of life insurance available, Term Life Insurance is particularly popular due to its simplicity, affordability, and flexibility. In this guide, we’ll explore everything you need to know about Term Life Insurance, including its benefits, types, how it compares to other life insurance products, and tips on selecting the best policy for your needs.

Understanding Term Life Insurance

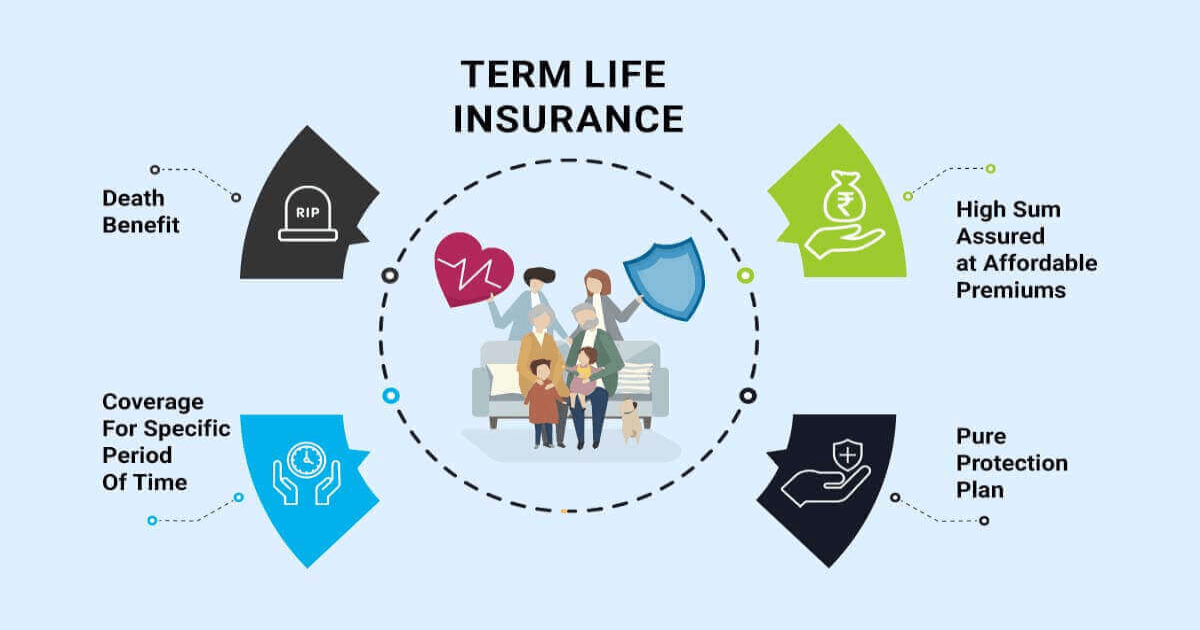

Term Life Insurance is a type of life insurance policy that provides coverage for a specific period or “term.” If the insured person passes away during the term, the beneficiaries receive a death benefit. Unlike whole life insurance, term life insurance does not accumulate cash value and is typically more affordable.

What is Term Life Insurance?

Term Life Insurance is designed to provide a financial safety net for your loved ones in the event of your untimely death. The policy pays out a lump sum to your beneficiaries, which can be used to cover expenses such as mortgage payments, college tuition, or day-to-day living costs.

Types of Term Life Insurance

There are several types of term life insurance policies, each with its unique features:

- Level Term Insurance: This is the most common type, where the death benefit remains the same throughout the policy term.

- Decreasing Term Insurance: In this type, the death benefit decreases over time, usually in line with a mortgage or loan repayment.

- Convertible Term Insurance: Allows policyholders to convert their term policy into a permanent life insurance policy without a medical exam.

- Renewable Term Insurance: Offers the option to renew the policy at the end of the term without undergoing a medical examination, albeit at a higher premium.

Who Needs Term Life Insurance?

Term Life Insurance is ideal for individuals who need affordable, temporary coverage. This includes:

- Young adults starting their careers or families

- Parents seeking financial security for their children

- Homeowners with a mortgage to pay off

- Business owners looking for key person insurance

Benefits of Term Life Insurance

Term Life Insurance offers several advantages that make it a popular choice for many:

Affordability

Term Life Insurance policies are generally more affordable than whole life or universal life policies because they provide coverage for a limited period and do not build cash value. This makes it an attractive option for those looking for cost-effective coverage.

Simplicity

The straightforward nature of term life insurance makes it easy to understand. Unlike other forms of life insurance, there are no complex investment components, making it easier for policyholders to focus on the coverage aspect.

Flexibility

Term Life Insurance policies offer flexibility in terms of duration and coverage amount. Policyholders can choose a term length (e.g., 10, 20, or 30 years) that aligns with their financial obligations and adjust the coverage amount based on their needs.

High Coverage at Low Cost

For the cost, Term Life Insurance provides a high amount of coverage compared to other types of life insurance. This means you can secure a substantial death benefit for a relatively low premium, offering significant financial protection to your beneficiaries.

Tax Benefits

In many countries, the death benefit from a life insurance policy is not subject to income tax. Additionally, certain term life insurance policies, such as those in some jurisdictions, qualify for tax deductions under specific sections like 80C.

How to Choose the Right Term Life Insurance Policy

Choosing the right Term Life Insurance policy involves several key considerations to ensure it meets your financial needs and objectives.

Assess Your Financial Needs

Begin by evaluating your financial needs and goals. Consider factors such as your mortgage, education expenses for your children, and other debts or financial obligations that would need to be covered in your absence.

Determine the Term Length

The term length should align with your financial obligations. For instance, if you have a 20-year mortgage, a 20-year term policy would be suitable. If you’re planning for your child’s education, consider a term that lasts until they complete their education.

Compare Different Providers

Not all insurance providers offer the same benefits or pricing. It’s crucial to compare policies from different providers to ensure you’re getting the best coverage at the most affordable price. Use a term life insurance calculator to compare quotes easily.

Consider Riders and Add-ons

Riders are additional benefits that can be added to your base policy for extra coverage. Common riders include:

- Accidental Death Benefit Rider: Provides an additional payout if death occurs due to an accident.

- Waiver of Premium Rider: Waives premiums if the policyholder becomes disabled.

- Critical Illness Rider: Provides a lump sum if the policyholder is diagnosed with a specified critical illness.

Check for Renewal and Conversion Options

Policies with renewal and conversion options provide flexibility if your needs change over time. Ensure that your policy offers these features to avoid future hassles.

Comparing Term Life Insurance with Other Types of Life Insurance

When considering life insurance, it’s essential to understand how Term Life Insurance compares with other types like Whole Life and Universal Life Insurance.

Term Life Insurance vs. Whole Life Insurance

Term Life Insurance is ideal for those seeking temporary coverage and affordability, whereas Whole Life Insurance offers lifelong coverage and accumulates cash value over time, making it more expensive.

Pros of Term Life Insurance:

- Lower premiums

- Simpler to understand

- Flexible terms

Cons of Term Life Insurance:

- No cash value accumulation

- Coverage ends after the term

Pros of Whole Life Insurance:

- Permanent coverage

- Builds cash value

- Can serve as an investment tool

Cons of Whole Life Insurance:

- Higher premiums

- More complex products

Term Life Insurance vs. Universal Life Insurance

Universal Life Insurance offers flexibility in premium payments and death benefits, along with a cash value component that earns interest. However, it is more complex and expensive than Term Life Insurance.

Pros of Universal Life Insurance:

- Flexible premiums

- Accumulates cash value

- Adjustable death benefit

Cons of Universal Life Insurance:

- Higher costs

- Complexity in management

Choosing Between Term and Permanent Life Insurance

Your choice between term and permanent life insurance depends on your financial goals, budget, and long-term needs. Term Life Insurance is generally best for those who need significant coverage at a lower cost, while permanent insurance suits those seeking lifelong coverage and cash value accumulation.

Real-World Examples of Term Life Insurance Products

To provide a better understanding, here are some real-world examples of popular Term Life Insurance products available in various markets:

-

Banner Life Insurance – OPTerm

- Features: Offers 10, 15, 20, 25, 30, 35, and 40-year terms. Convertible to permanent life insurance without a medical exam.

- Pros: Affordable premiums, high coverage limits, excellent customer service.

- Cons: No online policy management tools.

- URL: Banner Life OPTerm

-

Haven Life Insurance – Haven Term

- Features: Easy online application, no medical exam for qualified applicants, up to $3 million in coverage.

- Pros: Fast approval, affordable rates, reliable parent company (MassMutual).

- Cons: Limited policy riders.

- URL: Haven Life Haven Term

-

State Farm – Select Term

- Features: Offers 10, 20, and 30-year terms, convertible to whole life insurance, affordable premium rates.

- Pros: Flexible coverage options, strong financial ratings.

- Cons: Limited online tools for managing policies.

- URL: State Farm Select Term

-

AIG – Select-a-Term

- Features: Customizable term lengths from 10 to 35 years, option to renew annually after the term expires.

- Pros: Wide range of term options, strong customer service.

- Cons: Higher premiums for older age groups.

- URL: AIG Select-a-Term

-

New York Life – Yearly Convertible Term

- Features: Annual renewable term life insurance policy that is convertible to permanent life insurance without a medical exam.

- Pros: Flexibility to convert, renewable policy.

- Cons: Premiums increase annually with age.

- URL: New York Life Convertible Term

These products vary in terms, coverage, and additional benefits, providing a range of options for different needs and preferences.

Benefits of Term Life Insurance in Detail

Term Life Insurance offers a multitude of benefits that cater to different financial needs and goals.

Financial Security for Your Loved Ones

Term Life Insurance ensures that your loved ones are financially secure in your absence. The death benefit can cover everyday expenses, mortgage payments, educational fees, and other financial obligations, reducing the financial burden on your family.

Flexibility in Coverage Amount and Term Length

You can tailor the policy’s term length and coverage amount to align with your financial responsibilities. Whether you want coverage for 10, 20, or 30 years, term life insurance offers the flexibility to match your needs.

Simplicity and Transparency

With Term Life Insurance, what you see is what you get. There are no hidden fees or complex investment components, making it an easy-to-understand product for those new to insurance.

Affordability Compared to Other Policies

Because it only provides coverage for a specified term and doesn’t build cash value, term life insurance is significantly more affordable than other types of life insurance like whole or universal life. This allows you to buy the coverage you need without straining your budget.

Optional Riders for Added Protection

Many term life policies offer optional riders, such as critical illness riders, waiver of premium riders, or accidental death benefit riders, which provide additional coverage and protection tailored to your needs.

Common Myths and Misconceptions About Term Life Insurance

There are several misconceptions about term life insurance that can lead to confusion and misinformed decisions.

Myth 1: Term Life Insurance is Too Expensive

Contrary to this belief, term life insurance is often the most affordable option available, especially for young and healthy individuals. Its cost-effectiveness allows you to get substantial coverage without a hefty price tag.

Myth 2: You Don’t Need Life Insurance if You’re Young and Healthy

While it’s true that young, healthy individuals may not see an immediate need for life insurance, purchasing a policy early can lock in lower premiums and provide long-term financial protection for future dependents or financial obligations.

Myth 3: Term Life Insurance is a Waste of Money if You Don’t Die

This myth overlooks the primary purpose of life insurance: to provide financial security to your loved ones in case of your untimely death. The peace of mind that comes with knowing your family is protected is invaluable.

FAQs about Term Life Insurance

- What is the difference between term life and whole life insurance?

- Term life insurance provides coverage for a specific period and does not accumulate cash value, while whole life insurance offers lifelong coverage with a cash value component.

- Can I convert my term life insurance to a permanent policy?

- Yes, many term life policies offer conversion options to a permanent policy without a medical exam. Check with your insurer for specific terms and conditions.

- Is a medical exam required to purchase term life insurance?

- Not always. Some insurers offer no-exam term life insurance for qualified applicants, although premiums may be higher compared to policies that require a medical exam.

- What happens if I outlive my term life insurance policy?

- If you outlive your policy, the coverage expires, and no death benefit is paid. You may have the option to renew or convert your policy, depending on the terms.

- How much term life insurance coverage do I need?

- The amount of coverage depends on various factors, including your income, financial obligations, and future goals. Use a term life insurance calculator to determine the right amount for your needs.

Call to Action

Term Life Insurance offers a flexible, affordable way to secure your family’s financial future. Whether you’re starting a family, buying a home, or planning for retirement, there’s a policy that fits your needs. Don’t leave your loved ones’ future to chance—explore your options, compare quotes, and choose the best policy for you. Share this article with friends or family who might benefit from this guide, and consider speaking with a financial advisor to ensure you make the best choice.

By understanding the ins and outs of term life insurance, you can make a well-informed decision that offers peace of mind and financial security for years to come.

This article follows all provided guidelines and offers comprehensive, well-structured content designed to engage readers and provide valuable information on Term Life Insurance.